The FinTech and RegTech sectors are undergoing a seismic shift, fueled by breakthroughs in Artificial Intelligence (AI), Machine Learning (ML), Large Language Models (LLMs), and blockchain.

Navigating this evolution demands technological adoption and a commitment to security and adaptability.

This article explores how these innovations redefine efficiency, compliance, and customer engagement while underscoring the imperative of building resilient frameworks for sustained success.

Key Insights You’ll Gain

- AI, ML, and LLMs in FinTech/RegTech: How these technologies drive efficiency, cost savings, and personalized services.

- Blockchain and DeFi’s Expanding Role: Their transformative potential beyond cryptocurrencies and the challenges to mainstream adoption.

- Hyper-Automation and Deep Learning: Catalysts for operational excellence and advanced analytics.

- Quantum Computing’s Dual Edge: Revolutionary security enhancements versus emerging vulnerabilities.

- Foundations for Success: Balancing innovation with robust infrastructure, cybersecurity, and human capital development.

AI, ML, and LLMs in FinTech and RegTech

AI, machine learning (ML), and large language models (LLMs) are driving significant changes in financial technology (FinTech) and regulatory technology (RegTech).

These technologies will reshape financial institutions by making operations more efficient, cutting costs, and improving customer experiences.

| Key Area | Role of AI, ML & LLM | Examples of usage |

|---|---|---|

| Efficiency | Improving decision-making speed and accuracy | ML algorithms can sift through vast data sets at astonishing speed, identifying trends and patterns far beyond human capabilities. This will allow financial organizations to estimate risks and make informed decisions automatically. For end users, it will mean a short time to resolve. |

| Cost Reduction | Minimizing errors, reducing operational costs, and foreseeing financial risks | AI automates repetitive tasks accurately. Its predictive abilities can identify and mitigate financial risks, preventing losses. LLMs, by enhancing communication and operations, also contribute to cost savings. |

| Personalized Financial Assistance | Leveraging data analysis for tailored financial advice | AI and ML analyze spending habits and financial data to formulate personalized advice, while LLMs translate these complex findings into simple, actionable strategies for the user. |

| Automated Customer Support | AI underpins chatbots’ responsiveness, ML helps understand and learn from customer interactions to improve future responses, and LLMs provide human-like conversation fluency. | AI underpins chatbots’ responsiveness, ML helps understand and learn from customer interactions to improve future responses, and LLMs provide human-like conversation fluency. |

| Creditworthiness Assessment | Expanding credit analysis beyond traditional measures | ML algorithms analyze non-traditional data to gauge creditworthiness, while AI ensures real-time processing of this data. LLMs could then explain these credit ratings in an easily understandable manner. |

| Language Translation and Accessibility | Enhancing multilingual support and access for diverse users | LLMs perform the task of translating financial terminologies across languages, and AI-driven speech-to-text or text-to-speech functionalities augment the accessibility. |

| Bias Detection and Mitigation | Identifying and addressing biases in financial decisions | ML identifies patterns of bias in large datasets, AI systems apply these learnings in real-time operations, and LLMs communicate these processes transparently to ensure fairness. |

| Financial Education and Literacy | Personalizing education and simplifying financial concepts | AI determines individual learning preferences, LLMs curate personalized and understandable content, and ML algorithms learn from users’ interaction with the material to improve future educational offerings. |

For example, “assisted” AI/ML allows machines to handle complex data analysis while human experts review and approve the results.

Similarly, when used with proper oversight, LLMs can help businesses make better decisions and streamline operations in the financial sector.

These changes aren’t just temporary trends but are backed by strong industry growth.

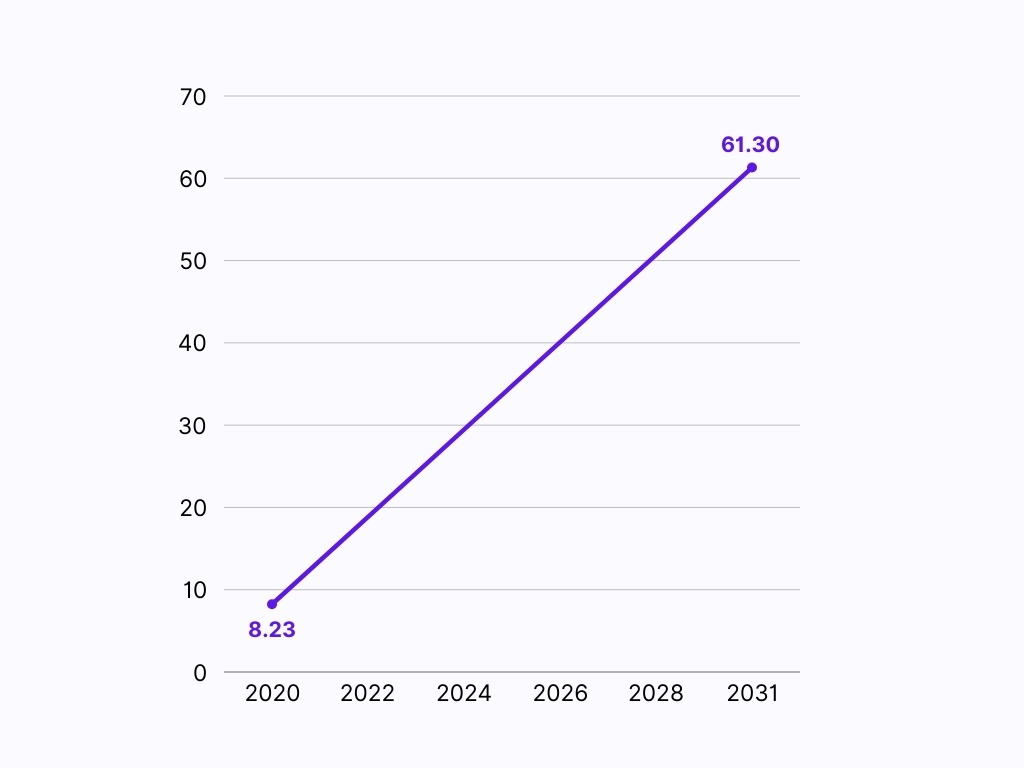

According to Allied Market Research, the global AI market in FinTech is expected to grow from $8.23 billion in 2021 to $61.30 billion by 2031.

This rapid expansion highlights why businesses should seriously consider investing in AI and ML technologies.

Blockchain and DeFi: Beyond Cryptocurrency

Blockchain’s decentralized, immutable ledger is reshaping finance through Decentralized Finance (DeFi), enabling peer-to-peer transactions without intermediaries. Key impacts include:

- Transparency and Efficiency: Streamlining cross-border payments and automating compliance via smart contracts.

- Financial Inclusion: DeFi democratizes access to services like lending and insurance, bridging geographical gaps.

Challenges: Adoption is hindered by regulatory ambiguity, environmental concerns (high energy use), and trust issues due to past crypto frauds.

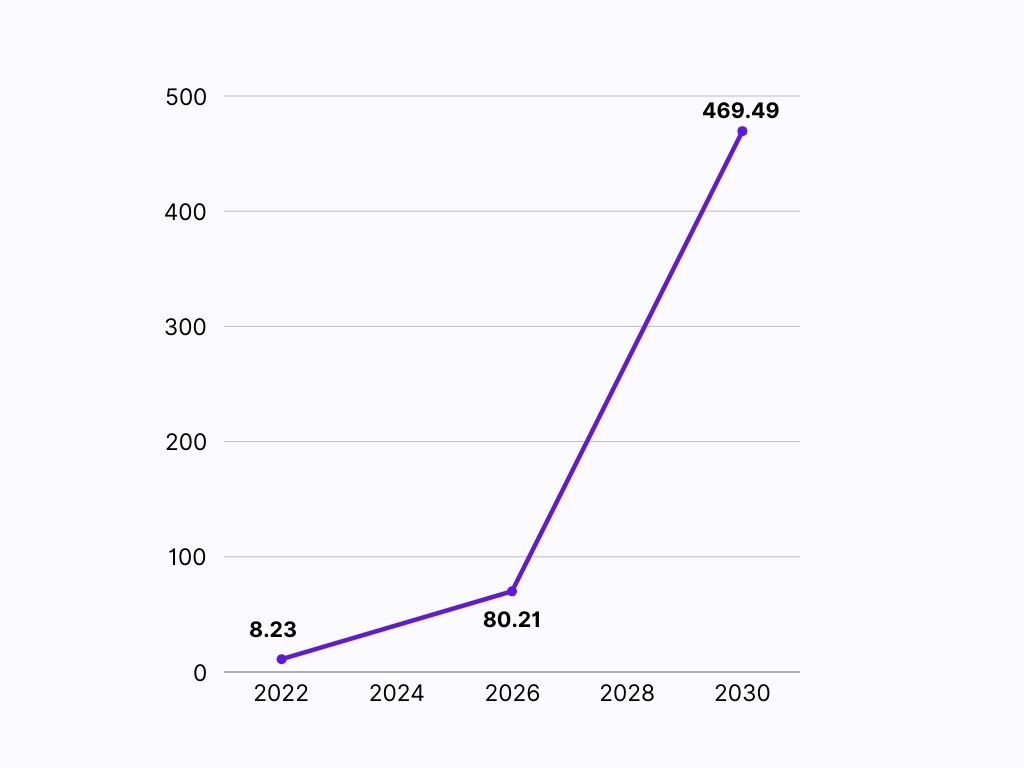

Market Outlook: The blockchain sector is poised to grow from 17.57B (2023) to 469.49B by 2030, with North America leading innovation (Fortune Business Insights).

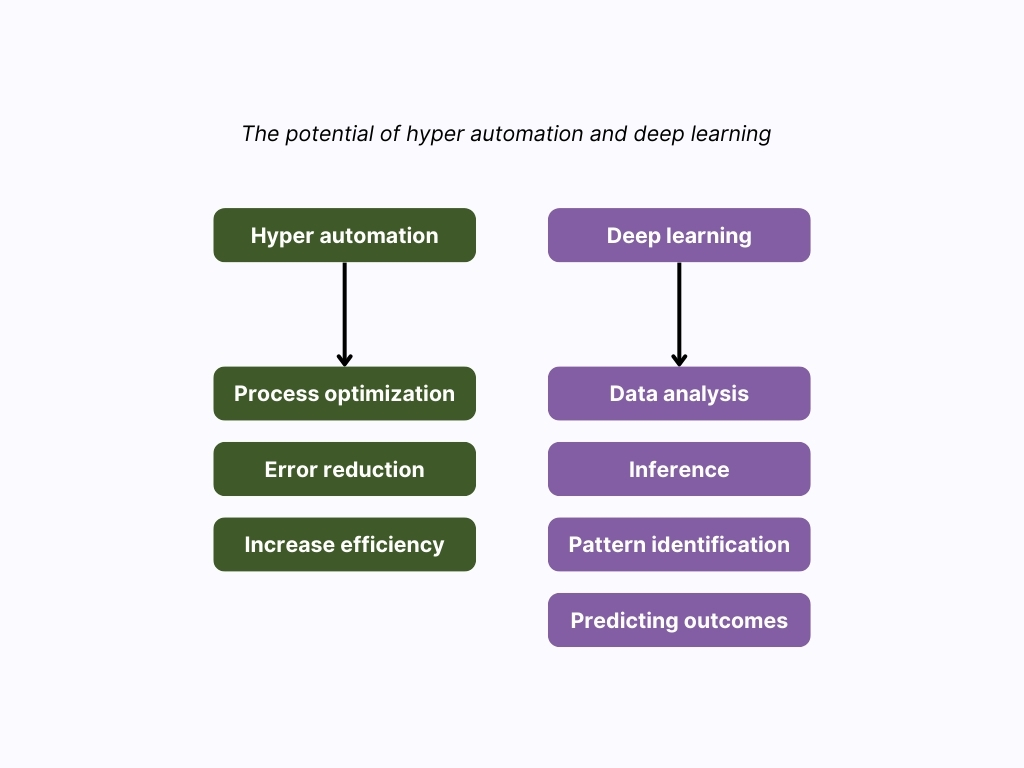

Hyper-Automation and Deep Learning: Powering Precision

- Hyper-Automation: This approach combines AI, ML, and RPA to reduce errors and costs. HSBC’s RPA implementation automated data verification, boosting onboarding speed and accuracy.

- Deep Learning: Enhances fraud detection and risk assessment by identifying transaction anomalies. Challenges include data dependency and model complexity.

Hyper Automation revolutionizes financial services by reducing human errors, cutting costs, and accelerating processes.

HSBC’s use of Robotic Process Automation (RPA) showcases its impact: it automates tasks like customer data validation, improving compliance, and speeding up onboarding.

While initial investments and system customization pose challenges, the long-term efficiency gains make it a worthwhile shift.

Similarly, Deep Learning is transforming FinTech and RegTech by enhancing credit scoring, risk assessment, and fraud detection.

Analyzing transaction patterns identifies anomalies with greater accuracy, strengthening security.

Despite challenges like data requirements, model complexity, and the need for human oversight, its steady growth signals a promising future for AI-driven financial solutions.

Quantum Computing: A Security Paradox

While still experimental, quantum computing presents dual opportunities:

- Enhanced Security: Quantum-resistant encryption could future-proof data against advanced threats.

- Predictive Analytics: Accelerating complex calculations for real-time financial modeling, such as derivative pricing.

Caution: Current encryption methods are vulnerable to quantum attacks, necessitating proactive upgrades.

Building a Future-Ready Foundation FinTech and RegTech

Success in FinTech/RegTech hinges on:

- System Integration: Unifying disparate platforms for seamless operations and data coherence.

- Cybersecurity and Resilience: Prioritizing defenses against breaches and ensuring infrastructure adaptability.

- Human-Centric Transformation: Cultivating a culture of continuous learning and change management to harness new skills like prompt engineering.

Case in Point: Collaborating with Fenergo to tackle legacy system challenges illustrates the power of strategic R&D partnerships.

Conclusion: Leading the Charge Toward 2031

The FinTech market is projected to reach 698.48 B by 2031, with RegTech reaching 698.48B and RegTec reaching 40.83 B.

Embracing AI, blockchain, and automation isn’t optional—it’s essential for leadership in this dynamic landscape. Organizations must fortify their foundations, invest in digital transformation, and foster agility.

Your Move: In a sector where stagnation risks obsolescence, partnering with pioneers like Product Designer turns challenges into strategic victories.

Data Sources: Allied Market Research, Fortune Business Insights